The IKIO Lighting Ltd has commissioned its additional capacity in May 2024 as part of its Block II Greenfield Project, which spans approximately 5 lakh square feet. This expansion focuses on manufacturing LED home lighting, solar panel systems, and other new product lines.

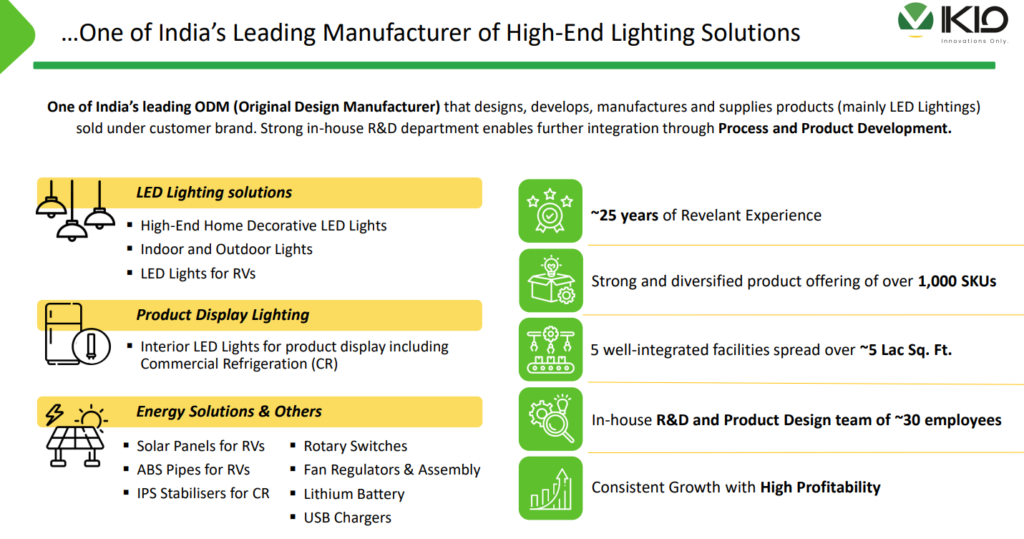

The company operates 6 manufacturing facilities and offers a diverse portfolio of over 1,300+ certified products.

Performance Updates

- Gross Margin: The gross margin (excluding the USA subsidiary) stayed in line with expectations. As operations stabilize in the USA subsidiary, margins are expected to improve in the future.

- EBITDA Margin: The margin was impacted by front-loaded expenses, particularly higher employee costs related to team expansion for the new facility and product categories. However, revenue contribution from these new initiatives is anticipated from H2 FY25 onward.

- Depreciation Impact: The higher depreciation was due to the commercialization of the new facility.

IKIO Lighting received a summon on March 21, 2024, from the GST Authority, focusing on the company’s availing of Input Tax Credit (ITC) related to expenses incurred during its Initial Public Offering (IPO).

As of June 2024, IKIO Lighting’s promoters slightly increased their holdings from 72.46% to 72.50%.

As of October 1, 2024, the price-to-earnings (P/E) ratio of IKIO Lighting Ltd is 38.22. This is a 23% discount to the median P/E ratio of its peers, which is 49.46.

After listing with issue price of 285, and listing at 392 and QIB subscription 163 times, stock corrected from high of 475 to life low @245. now struggling Support at 270 to resistance 330 from more than eight months.

IKIO Lighting Limited | IKIO INDIA

Disclaimer-

It’s important to note that discussions like are for informational purposes only and should not be taken as specific We are not SEBI registered investment advisor. Whether analyzing a company’s financial health, examining market trends, or discussing technical chart patterns, the goal is to provide insights and perspectives that can help you make more informed decisions according to your own research and investment strategy. Always consider consulting with a financial advisor or conducting thorough personal research before making any investment decisions.