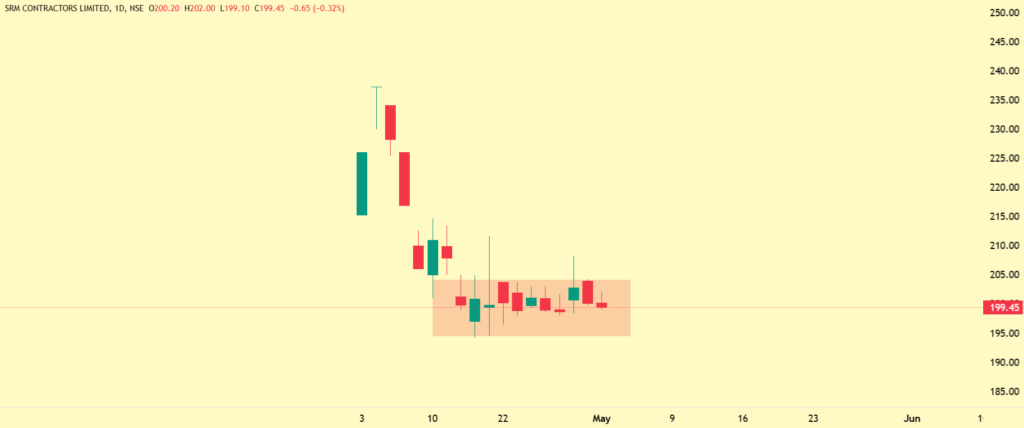

#NSE0003– Stock on Radar– SRM Contractors raised Rs 130.20 crores through a book-built issue, issuing 0.62 crore shares entirely as a fresh issue. The shares were issued at a price of Rs 210 At listing date, April 3, 2024.The 60 times subscription rate for the Qualified Institutional Buyers (QIB) category is a strong indicator of institutional confidence in the company. High subscription rates often suggest a positive market sentiment and can lead to strong initial trading days. With the stock now “on the radar,” this suggests monitoring for potential breakout movements from the current trading range (Darvas Box). Investors should watch for increased trading volumes and other technical indicators to confirm breakout before considering an investment decision.

In summary, SRM Contractors appears to be a newly public company that has attracted significant interest, particularly from institutional investors. The use of advanced trading analysis like the Darvas Box might help in making informed decisions about entering or exiting a position based on confirmed patterns. As always, combining these insights with a broader fundamental analysis and keeping an eye on overall market conditions is advisable

Disclaimer-

It’s important to note that discussions like ours are for informational purposes only and should not be taken as specific We are not SEBI registered investment advicer. Whether analyzing a company’s financial health, examining market trends, or discussing technical chart patterns, the goal is to provide insights and perspectives that can help you make more informed decisions according to your own research and investment strategy. Always consider consulting with a financial advisor or conducting thorough personal research before making any investment decisions.